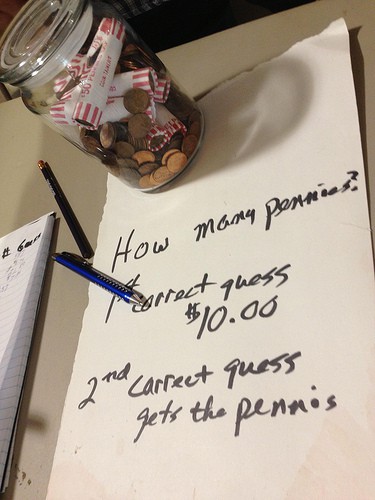

Don’t leave yourself guessing about old financial records. Back up now. Photo by Becky McCray.

Backing up your accounting data used to mean printing off reams of paper reports stuffed into boxes, and then you had to find a place to keep all that. Today, backing up your accounting data means generating a few PDFs and keeping extra copies electronically.

1. Save PDF versions of year-end accounting reports

Accounting systems change. In over 20 years with computers, I can’t even remember how many different accounting systems I’ve used. There’s no assurance you’ll be able to read your accounting data next year. Today it’s easy to create PDF that will be readable even after you change software systems. Here are the reports to save:

- Profit and Loss, Jan 1 – Dec 31

- Balance Sheet, dated Dec 31

- Detail of every transaction, Jan 1 – Dec 31

- Payroll tax details for each employee, Jan 1 – Dec 31

Make sure you backup these important reports into more than one location.

2. Download online banking statements

Think about all the banking-related services you use online: PayPal, online banking, Square, Dwolla, and others. These are key financial records that you don’t want to lose, and most of them limit how long you can download detail. For my local bank, I have access to one year of statements. PayPal recommends downloading your history each and every month. So now is the time to download PDF copies of all your banking transactions.

3. Backup your cloud

Quick! How many different cloud services are you using? Google Docs/Drive, Evernote, iCloud, DropBox, and all the others are wonderful, until they don’t work. Take time right now to export and save a copy of all important documents in your cloud services. You can back them up to another cloud service, or to a local hard drive. With portable hard drives under $100 and online backup systems under $100 per year, it’s a good investment in your business.

New to SmallBizSurvival.com? Take the Guided Tour. Like what you see? Get our updates.

- About the Author

- Latest by this Author

Becky started Small Biz Survival in 2006 to share rural business and community building stories and ideas with other small town business people. She and her husband have a small cattle ranch and are lifelong entrepreneurs. Becky is an international speaker on small business and rural topics.